INVEST PASSIVELY, WORK LESS

Guaranteed cashflow regardless of government shutdowns, pandemic events or the sitting president. We win when our investors win.

TOP REASONS WHY BUSY PROFESSIONALS BENEFIT FROM PASSIVELY INVESTING IN REAL ESTATE

Discover why this particular style of real estate investing is the right strategy for busy professionals.

HOW TO BUILD HASSLE-FREE WEALTH

Are you frustrated with the volatility of the stock market and the risk of a market correction with stocks being in never-before-seen territory? Will the low returns from savings accounts and bonds have you working until you drop?

For many startups, venture capitalists are happy if 1 out of 10 investments show positive returns. We have a safer opportunity tied to government backed funds.

What if there was a proven way to create wealth faster while receiving multiple tax efficient passive income streams?

Hart Capital is a private equity firm that makes it easy for you to passively invest in lucrative government backed real estate investments.

Finally, you can invest in tax-advantaged real estate without having to deal with the nuisance or complication of purchasing and managing a property yourself.

Our simple step-by-step process allows you to accelerate your wealth creation so you can live life on your own terms, whether that means traveling the world, spending more time with family and friends, or making an impact.

TAX EFFICIENT PASSIVE INCOME

The U.S. Tax code provides numerous ways for real estate investors to shield a portion of the positive cash flow investors receive.

ATTRACTIVE RETURNS

Our Section 8 real estate returns have the best risk-adjusted return of any real estate asset class, stocks, bonds, and REIT’s for the past 20 years.

DEPENDABLE CASH FLOW

Section 8 real estate investment income is fueled by 12 to 60 month tenant leases, which provide a regular and dependable income stream that should produce positive cash flow higher than typical stock dividends.

EXPERIENCED PARTNERS

We do all the hard work to find and acquire ideal properties, and then oversee asset management after purchase, while our investors sit back, relax, and receive tax-advantaged passive cash flow.

20 UNITS UNDER PROPOSAL

IS ROUGHLY

$1.44M+

PROJECTED PORTFOLIO VALUE

$2.52M+

PROJECTED ASSETS UNDER MANAGEMENT FIRST YEAR

SAMPLE PROPERTIES WITH POSITIVE NET CASHFLOW

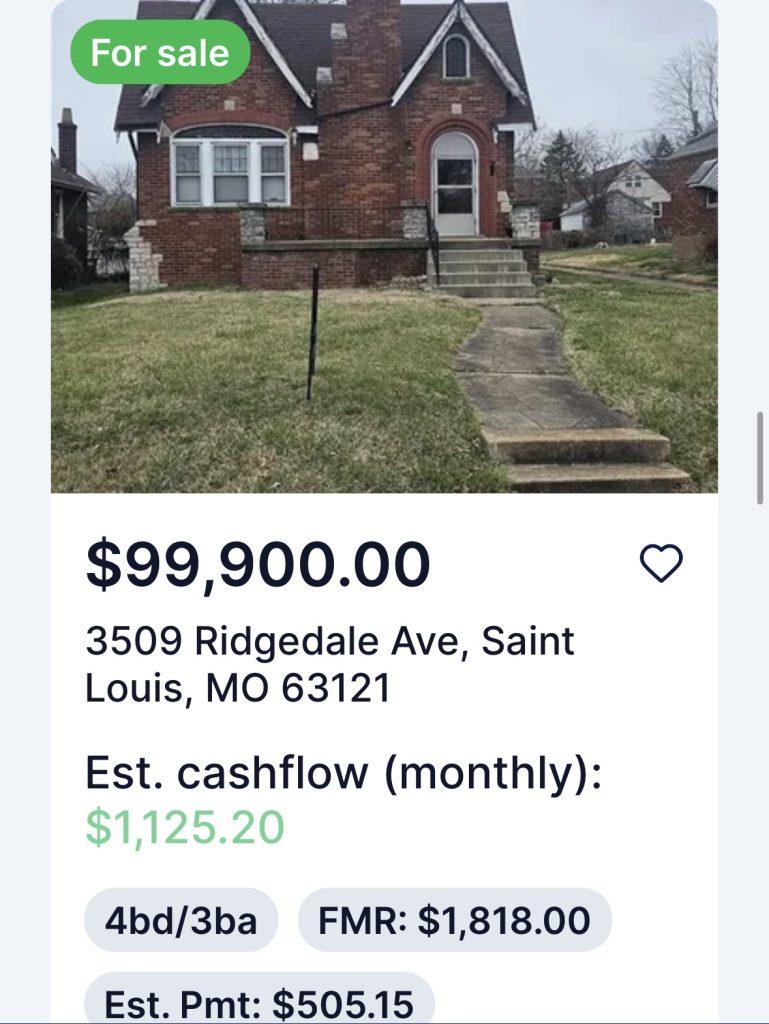

PROSPECTIVE PROPERTY #1

- Single Family Home

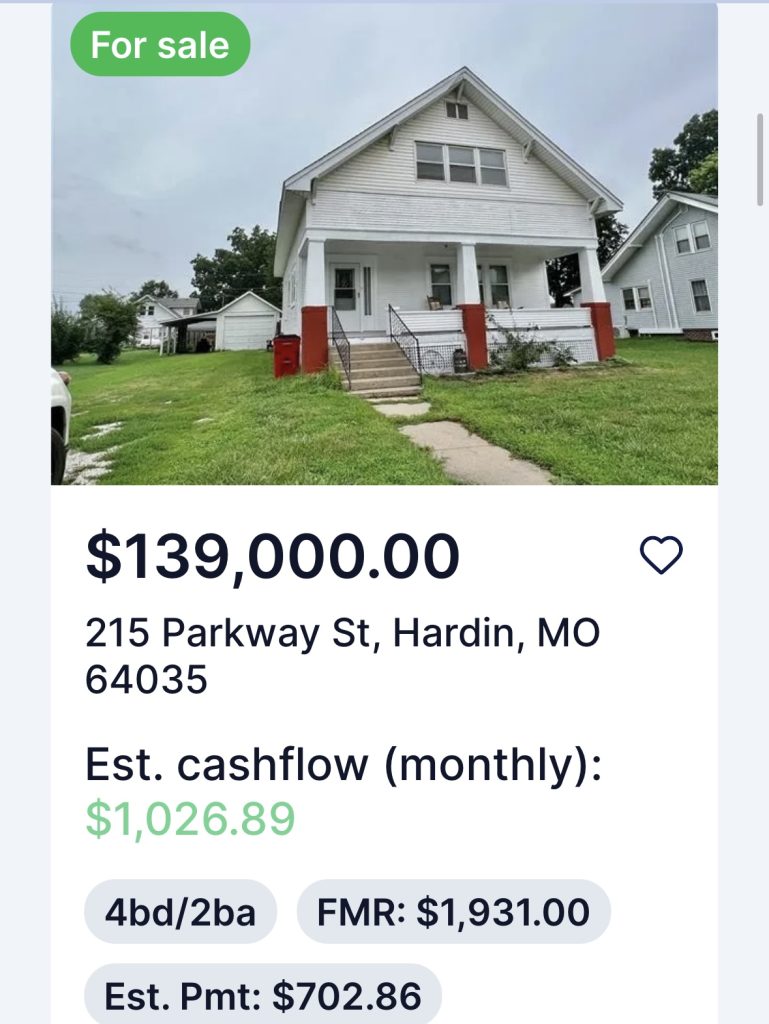

PROSPECTIVE PROPERTY #2

- Single Family Home

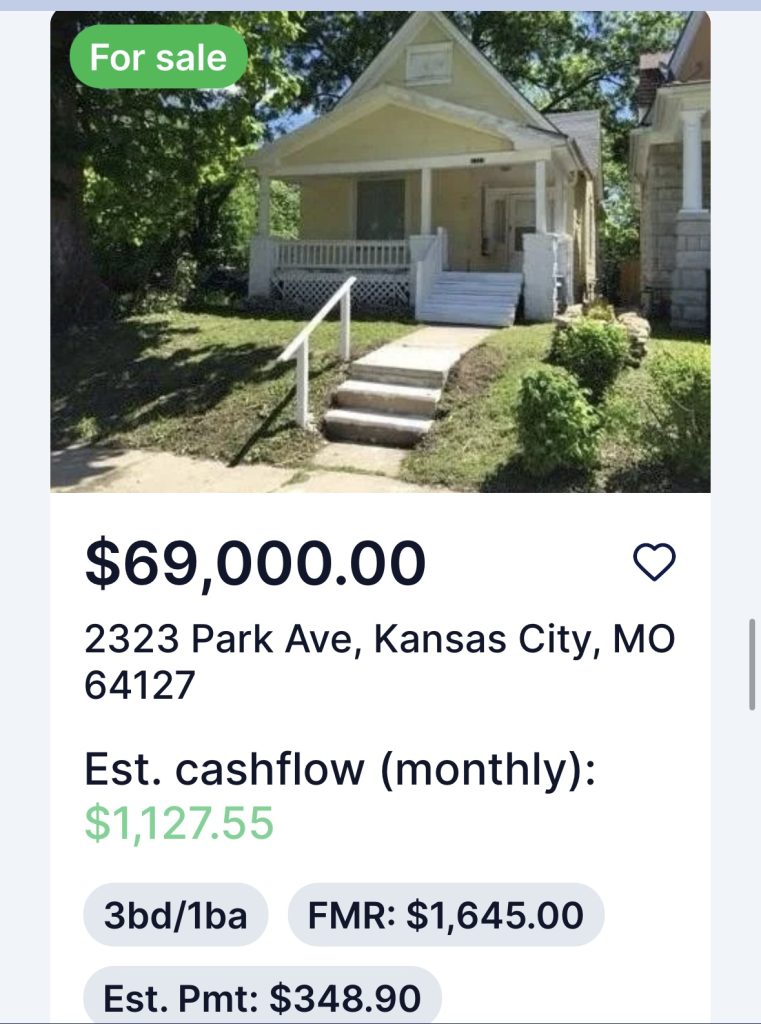

PROSPECTIVE PROPERTY #3

- Single Family Home

STOCKS OR REAL ESTATE?

- Goldman Sachs estimate only a 3% annualized total return during the next 10 years with the S&P 500.

- Most investors don’t realize that the same $100,000 isn’t actually worth $277,454 15 years later, because of the volatility of the stock market year after year. Actually, that same $100,000 is actually worth $225,425, which is only a 5.6% return compounded annually. Not nearly as good but not too bad, until you realize that these returns are before brokerage fees!

- We are in the longest bull market in history, with valuations seen at previous market tops.

- A smart investing strategy at the end of a bull market, when the risk of sudden and significant drops are more likely, should be very different from the early years of a new bull market.

- While stocks trail only real estate for highest annualized returns from 1993 to 2013, stocks have significantly more annualized risk. Only commodities have more risk of the major investment asset classes.

- The average stock market return over the last 15 years was 7.04% from 2005 to 2019 and 9.06% over the last 30 years from 1990 to 2019. That means that if you invested $100,000 in 2004 it would be worth $277,454 in 2018, which doesn’t seem that bad, but there’s more to calculate.

Making smart investing decisions requires balancing your risk tolerance, goals, market cycles, and investment timeline. What’s best for one investor may not be best for another investor.

WHY WE INVEST IN SECTION 8 GUARANTEED RENTAL INCOME

The Covid Pandemic taught us a lot about potential setbacks with job loss, reduced rental income from private tenants, and the benefits of Section 8 home investing:

- Guaranteed Income: The federal government pays us the tenants rent directly, on the 1st of every month, guaranteed without fail. We can opt for direct deposit or a check.

- Lower Turnover: Section 8 tenants stay in the properties for a much longer period of time compared to private tenants. We consistently have tenants stay in the units for 6.9+ years.

- Leverage: Section 8 tenant don’t want to lose their free housing assistance. This means they are much more likely to follow the terms of your lease, because if they break your agreement, you can report them to the housing authority and they can be kicked out of the program indefinitely.

- Rapid appreciation: Placing a tenant with guaranteed rental income is much more attractive to future investors. With 3-5 year signed leases, this makes the portfolio very attractive in the event of a sell off. Force appreciation faster. Rent increases are 3-5% every year.

Project your hard earned retirement while helping the economically disadvantaged have safe and affordable housing.

HOW MUCH CAN BE MADE WITH SECTION 8?

The income potential with Section 8 is unlimited. Here are the key points to know:

- The income is guaranteed, meaning it’s always deposited regardless of the situation. For examples, during the global pandemic, payments were always made to investors. Guess how many non-section 8 landlords lost money when their tenants lost their jobs? 2020 was the best year for many investors because of this.

- Scalability: Forecasts show an average of $15,600/per year on every unit. We aim to spend an average of $72,500 per rental house. The price of S8 units are much lower and the rents are higher than market rent in most cities. This allows you to make hundreds of thousands per year, with limited up front investments.

- Appreciation – Most Section 8 units aren’t always in the best parts of town, but that is offset by the stability in the rental income. Overall appreciation in S8 portfolios are higher than private tenants. This is because investors and banks are a lot more comfortable working with “affordable house” that is paid by the US government, not to mention tax incentives.

A SMARTER INVESTMENT STRATEGY

Single family real estate investing has proven to be one of the best asset classes for long-term wealth accumulation. It is coveted by the wealthy as a valuable addition to traditional stocks and bonds. And not only is it an excellent hedge against inflation and recession, but owning real estate provides significant tax advantages compared to stocks and bonds.

ECONOMIES OF SCALE

We can purchase multiple properties in a single transaction to have built-in economies of scale. You can add 10-20 units per month with a single transaction.

EFFICIENCY

Owning a hand-picked portfolio of homes is safer in the long run that buying 100 properties from an seller that may have mixed in 20-30 bad units with bad tenants and below market rents.

RETURN ON INVESTMENT

Guaranteed rents with long term leases enjoy a higher return on investment (ROI) because they typically have a lower cost per door, management is typically more effective and profitable, and improvements increase the rental value of all units, not just one.

RISK

Many markets have too many apartment complexes with low occupancy rates and competing pricing. Section 8 FMR rents pay above private market rents and pay on time, every first of the month.

We can help you take full advantage of the compelling benefits of home ownership by leveraging our knowledge and network to acquire properties with stable cash flow and long term appreciation.

Come join us and enjoy the benefits of passive real estate investing. We’ll do ALL the work while you sit back and receive cash flow!

ARE YOU IN CONTROL OF YOUR TIME AND YOUR LIFE?

Discover a safe investment alternative with above average returns, lower volatility, and consistent cash flow…

HOW TO GET STARTED

1. Sign Up

The first step is to invest with us is to fill out our Interest Form.

2. Connect

We'll discuss your goals and help project potential cashflow based on your investment amount to help you meet those goals.

3. Invest

We'll help you understand every step of the process to investing with us including partnership documents.

4. Enjoy

Sit back, relax, and receive monthly cash flow payments from your passive investments as we acquire properties and place tenants.